Netball Australia has released its annual report, and the headline outcomes are positive for the organisation. It comes amidst a week that has thrown the governing body, and the sport into chaos, as Collingwood undertakes a review of its Super Netball licence, potentially not continuing after the 2023 season.

But the annual report takes us back to the period from 1 January 2022 to 31 December 2022 - a period that had some massive highs (like a Quad Series win, a Commonwealth Games gold medal, and the biggest-ever Super Netball Grand Final crowd) and some terrible lows (announcing a partnership to sell hosting rights to said Grand Final, withdrawal of a major sponsorship with Hancock Prospecting).

But looking back, Netball Australia has been able to frame it as a positive year. Almost a quarter of a million fans were through the gates of Super Netball matches, in the first full season back with crowds after two years affected by COVID-19 and hubs, and Netball Australia reported almost a million participants across the country in grassroots, amateur, and professional netball.

Those statistics paint the picture of a sport bouncing back healthily, after two devastating years of COVID-19, with participation back at levels higher than before the pandemic, and crowd and engagement numbers returning.

The non-financials

Netball's participation in Australia is up on pre-COVID-19 levels, as the sport looks to rebound at every level. The reporting period reflects the first season back at social sport after COVID-19, so the result is encouraging for netball.

The more fans that are engaged at a grassroots level, the easier it is for the high-performance part of the sport to function, with more fans to engage with, and more money in state associations to fund competitions/court hire/community events.

Netball reached more people than ever before in Australia last year. Aside from a new record crowd for the Super Netball Grand Final, and sellouts across three of the four international matches in Australia, there was also increased reach.

Netball Australia reported more followers across social media, but the biggest jump was in the broadcast. In 2021, Nine Network broadcast 67 hours of Super Netball content. In 2022, this was multiplied more than 11 times over, with Fox Sports broadcasting 773 hours of Super Netball content, across magazine shows, replays, minis, and pre/post-game coverage.

The first year of the broadcast deal was a strength for Netball Australia, and there were strong viewership numbers to back that up. And that's before the financials come into play.

The financials

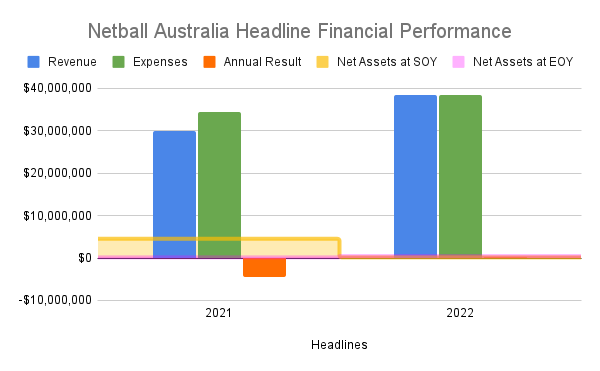

The headline numbers for Netball Australia (NA) show some strong positives and some glaring negatives.

The latest financial reporting period had a big jump in revenue - and a smaller jump in expenses. Instead of a massive $4.4m loss, NA reported a small $299,901 profit in 2022.

Headlines | 2021 | 2022 |

Revenue | $30,004,232 | $38,373,839 |

Expenses | $34,373,068 | $38,433,938 |

Net Assets at | $4,527,554 | $158,718 |

Net Assets at | $158,718 | $458,619 |

Annual Result | -$4,368,836 | $299,901 |

Given that last year, NA was issued a "Going Concern" notice by its auditors, the profit reported this year is significant.

NA also reported that the $4.2m bank debt owing, which was previously payable in May and August 2023, has been extended to August 2025, giving NA more time to find the assets to pay it down (although presumably at the cost of a higher interest payment over that time). But that result is a win, as a payable amount now could cripple the organisation and the sport in Australia.

There was talk last year of private equity interest in buying NA, and taking over ownership of the sport. The reported bid was for $6.5m. Carrying $4.5m in debt, that meant that the assets and goodwill of NA, including Super Netball was worth $2m, a pretty small sum for a business with $38m in revenue.

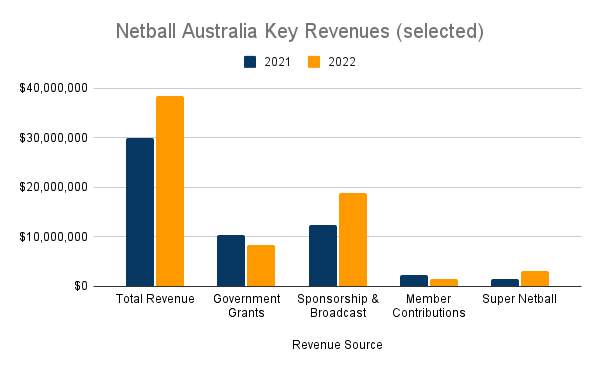

NA reported a significant uptick in revenue in the last year, with some of the key components of that revenue highlighted in the chart below.

The total revenue was up significantly, but the biggest driver of that was an increase in sponsorship and broadcast revenue. The majority of that jump is from two sources - the renewal of Suncorp's sponsorship of the Super Netball competition, reported at the 2021 Grand Final, and the Fox Sports broadcast deal, in its first year last year.

Revenue | 2021 | 2022 |

Total Revenue | $30,004,232 | $38,373,839 |

Government Grants | $10,361,446 | $8,433,423 |

Sponsorship & Broadcast | $12,498,342 | $18,807,723 |

Member Contributions | $2,388,014 | $1,592,012 |

Super Netball | $1,554,306 | $3,110,279 |

The high levels are likely to be sustained, and even grow further, with sponsorships with Origin Energy and Guzman y Gomez not included in this report. This will need to be the case, with government grants likely to continue to fall as the effect of COVID-19 wanes, and government money is focussed on the cost of living crisis.

With member contributions down, state associations were not asked to pay as much to NA last year, a change that will hopefully trickle down and help secure the strength of the state associations.

CEO Kelly Ryan, in her statement in the report noted that revenues were behind budget by $3.8m in this financial report - meaning that the budget was to have more than $42m in revenue, rather than the $38.4m. That gap would have made a significant dent in either the debt or could have been put forward for coming expenses.

The gap in revenues was attributed to a lack of commercial partnerships and sponsorships coming on board - like the withdrawal of Hancock Prospecting's sponsorship, and the start of the Visit Victoria sponsorship. The new sponsorships will only have small amounts in at this stage, with the benefits and payments likely staged over a period of time.

It puts pressure on the incoming sponsors, who will help cover some of that gap, but $3.8m is a lot of money, especially for NA who are more than $4m in debt.

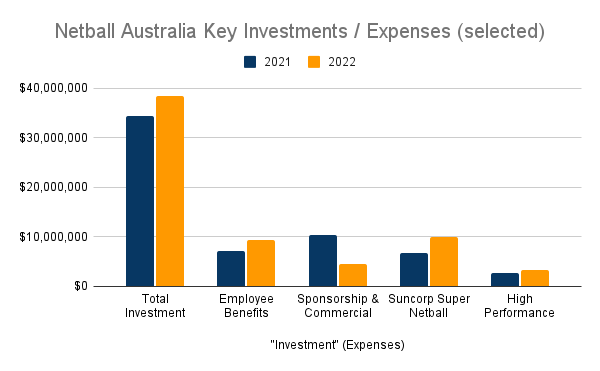

On the flipside of the coin, expenses were also up for Netball Australia, but not as significantly as revenue.

Super Netball and NA employees remain the biggest drivers of costs, accounting for almost half of all expenses in those two line items. Those costs are difficult to reduce unless cost-cutting measures exist within those spheres, but at the end of the day, Super Netball costs what it costs, and NA needs employees to run its business, and high-quality employees should be fairly remunerated.

"Investment" (Expenses) | 2021 | 2022 |

Total Investment | $34,373,068 | $38,433,938 |

Employee Benefits | $7,234,543 | $9,321,300 |

Sponsorship & Commercial | $10,330,401 | $4,505,416 |

Suncorp Super Netball | $6,796,236 | $10,028,298 |

High Performance | $2,635,268 | $3,315,347 |

The increased spending on High Performance relates to the Diamonds program, which funded trips to the Quad Series and the Commonwealth Games in England, as well as the standard costs for running the Diamonds program.

Ryan's statement noted that operating expenses were more than $3m below budget, as cost-cutting measures kicked in, as well as $1m saved in depreciation. The depreciation is nice for NA, but doesn't actually free up cash, and doesn't help funnel money into the sport - it simply means the existing long-term assets are worth more.

The shape of these expenses suggests that NA will have to focus on continuing to grow revenue (which, to its credit, it has), as many of these expenses are already on threadbare budgets.

The reason we know the budgets are already thin has been the speed of negotiations for the Collective Playing Agreements (CPA) for Super Netball and Diamonds players. NA is not able to easily meet demands for pay rises from players, and that negotiation is dragging on. There isn't anything in these reports that suggests that NA is hiding money from the players, there just isn't a lot to spare, unless revenue increases.

Super Netball

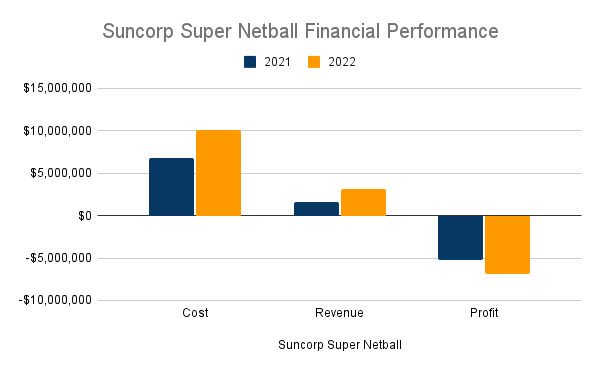

Super Netball is NA's biggest asset, its biggest expense, its showpiece and its most visible branding. But at the moment, it's not helping NA get where it needs to financially.

Not only is Super Netball a loss-maker, but it actually made a bigger loss in 2022, with crowds, than it did in 2021 during the hub-affected season.

Suncorp Super Netball | 2021 | 2022 |

Cost | $6,796,236 | $10,028,298 |

Revenue | $1,554,306 | $3,110,279 |

Profit | -$5,241,930 | -$6,918,019 |

At the moment, nobody can be shocked that Suncorp Super Netball is in the position it is in. The financial reality of SSN has been firmly in the spotlight all week, with Collingwood's announcement of its review of its licence.

SSN costs are likely to continue to increase, as players seek a new CPA that gives them a pay rise that starts to close the gap to what other female athletes are being paid. And players deserve that pay rise, no doubt, but NA's coffers are hardly full, and SSN isn't exactly profitable at the moment either.

Which begs the question - where to from here?

That's the question that NA, and CEO Kelly Ryan are going to have to answer and answer quickly. There are new sponsorship agreements kicking in in this reporting period, and more kicking in soon, but that bank debt keeps ticking and needs to be paid down over the next few years.

If players don't see a pay rise, it risks the pathway, as athletes may pursue careers in basketball, cricket, football or other sports around Australia. If players can make more money earlier, at lower levels than SSN, it's a tough decision for rising talent. Even more so for those players who harbour cross-code ambitions (like Ash Brazill and Maisie Nankivell previously).

What's next?

The first priority will be reacting and responding to the outcome of the Collingwood review of the Super Netball licence. There will be fallout, whatever it is, and NA will have to help sort that out.

If Collingwood stay in the competition, it will be dealing with whatever ramifications come from that deal, and making sure that players, coaches and staff are secure in their employment. If Collingwood relinquishes the licence, the focus will be on setting up a new team faster than is humanly possible.

Then focus will move to finalise the CPA with the Super Netball players - so that the 80 contract spots can be filled, and the players can have certainty about their future.

NA will also be focussing on building cash and assets to pay down the bank debt hanging over its head, which will be repaid in 2025.

After that, there are pinnacle events in 2026 (Victoria 2026 Commonwealth Games) and 2027 (Netball World Cup in Australia) to plan for and set the wheels in motion.

Alongside all of this, NA will be looking to boost revenue, mostly through sponsorship and commercial deals. And that's just the beginning.

Before you move on, why not give our Facebook page a like here. Or give our Twitter account a follow to keep up with our work here.

All statistics reported in this article are based on Netball Australia's 2021 and 2022 Annual Reports. Edge of the Crowd makes no warranty about their accuracy beyond that reporting, and cannot, and has not verified their accuracy. Copies of the Annual Reports for 2022 and 2021 are available in these links.