Treasurer Jim Chalmers has rejected calls from his backbench to follow the recommendations of the EIAC to raise the rate of Jobseeker in the upcoming budget. However, he called the topic a "live debate" and has not entirely ruled out some movement on Jobseeker.

The EIAC report has recommended an immediate and substantial increase to the base rates of working-age payments, including Jobseeker and Austudy. The single adult Jobseeker payment has remained stagnant in real terms since 2000 and has fallen dramatically compared to even the lowest-paid workers.

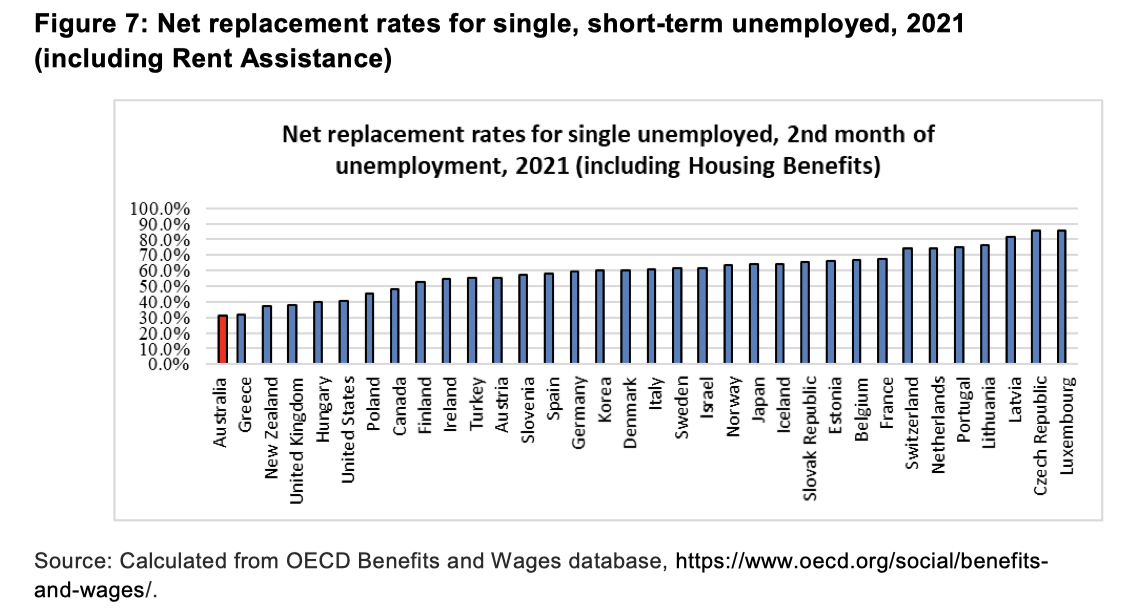

Australia also falls well below the pack compared to other OECD countries regarding unemployment benefits. When the higher cost of housing and rudimentary level of rent assistance is factored in, Australia is sent right to the bottom rung.

So many voices, all asking the government for one thing - to lift the most vulnerable in our community out of poverty by raising the rate of Jobseeker and Youth Allowance.

— David Pocock (@DavidPocock) April 26, 2023

Experts are telling us that the rate of payments is so low it's actually acting as a barrier to people… pic.twitter.com/AOGu0QR0n7

The Committee's report highlights the wild inadequacy of the CPI as an indexation for Jobseeker and the importance of not relying on arbitrary increases like 2021's $25 bump. The EIAC report cites the 2009 Harmer Pension Review, which shows that CPI does not capture the cost-of-living blowout experienced by the most economically vulnerable Australians.

If CPI is low, why is everything so expensive?

One main goal of the CPI is to compare identical goods and services over time. This seems intuitive initially but can result in massive distortions between actual costs over time and the measured CPI.

Simply put, product improvements place downward pressure on CPI even if, realistically, the price paid is increasing at a faster rate. The 2009 Henry Review showed that while CPI had rents rising by 22 per cent between 1995 and 2005, the ABS average showed rents increased by almost double that, at 42 per cent, over the same period.

For an oversimplified example, if your rent went from $100 to $150, but you now have amenities like an ensuite that previously would have been only in a $125 house, then CPI increased by $25. This is because even though you pay $50 more, you reside in something resembling a thing 'worth' $125, so like for like, you are only paying $25 more, not $50.

CPI also excludes increases in land value and the sale of already-built houses. This means that the rapid inflation of house prices in existing stock is not considered. Both skyrocketing land values and the runaway inflation of established housing stock have led to considerable increases in housing costs that the CPI partially ignores.

This same principle applies to many other goods, such as cars and electronics, that improve or gain function over time. As the CPI takes in a wide-ranging ‘basket-of-goods’ that includes costly and infrequent as well as everyday purchases, the inflation in the latter can get swallowed by the deflation of the former.

Do Jobseekers and plutocrats live the same lives?

The CPI is often called a 'plutocratic index' and is heavily weighted towards the spending patterns of higher-income households. This can account for the discrepancies between the CPI and the lived experience of those on lower incomes or Jobseeker.

In 2009 the Pensioner and Beneficiary Living Cost Index (PBLCI) was introduced to determine, in part, appropriate increases in aged pension payments. This is known as a 'democratic index' because it measures the cost of living of households facing broadly similar conditions. This is more accurate for a specific group of households, but it cannot be used to determine an overall figure like the CPI.

Australia is at the bottom of OECD countries in unemployment benefits, worse than Greece.

In place of the CPI, the EIAC report proposed several indexation methods for Jobseeker with increases up to $605 per fortnight. The report's final recommendation is to increase Jobseeker payments to 90 per cent of the current aged pension, an increase of $349 a fortnight and the lowest suggested indexation.

Treasurer Jim Chalmers established the interim EIAC last December to submit their report before this year's budget so that its recommendations can be considered. The Committee's recommendations are not binding but will be used to guide policy decisions in the 2023-2024 budget.

The report's recommended increase in Jobseeker would bring its real purchasing power in line with 1999 levels. However, the government's concern over inflation and the $34 billion price tag means Jobseekers might have to wait a bit before enjoying those sweet quarter-of-a-century-ago living conditions.

Before you move on, why not give our Facebook page a like here. Or give our Twitter account a follow to keep up with our work here.